Best Life Insurance for Smokers in 2024

The decision to get life insurance is an important one, especially for smokers who understand the increased health risks associated with tobacco use. While smoking can make life insurance more expensive, it doesn't mean you can't qualify for coverage. This guide explores life insurance options for smokers, explains how smoking affects rates, and helps you find the best companies for your respiratory health needs.

Smokers Pay More, But Coverage is Available

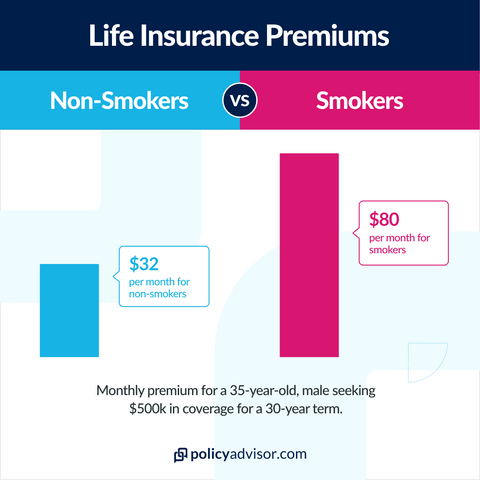

Life insurance companies base their rates on health risks, and smoking is a major one. Smokers can expect to pay two to three times more than non-smokers for the same respiratory health policy. This increased cost reflects the higher likelihood of health complications that could lead to a claim.

How Much More Expensive is Life Insurance for Smokers?

Let's look at a concrete example. Imagine a 30-year-old female considering a $500,000, 20-year term life insurance policy. As a smoker, she could pay an extra $10,200 over the policy term compared to a non-smoker. That's a significant difference, but it highlights the importance of securing coverage.

Term Life Insurance: Best for Smokers

Term life insurance is typically the most popular option for smokers due to its affordability and fewer health restrictions. While smokers will still pay more than non-smokers, term life premiums are generally lower than whole life insurance.

Here's a sample rate comparison (30-year-old, good health, $500,000 coverage, 20-year term):

| Age | Gender | Non-Smoker | Smoker | Rate Difference |

|---|---|---|---|---|

| 20 | Female | $22.65 | $60.59 | $37.94 More |

| Male | $30.20 | $76.43 | $46.23 More | |

| 30 | Female | $22.98 | $65.75 | $42.77 More |

| Male | $29.32 | $80.95 | $51.63 More | |

| 40 | Female | $35.27 | $113.40 | $78.13 More |

| Male | $42.94 | $145.39 | $102.45 More | |

| 50 | Female | $78.29 | $257.05 | $178.76 More |

| Male | $102.50 | $351.50 | $249.00 More | |

| 60 | Female | $194.16 | $617.51 | $423.35 More |

| Male | $268.04 | $887.93 | $619.89 More |

Methodology:

- Rates are for a 20-year term life insurance policy with $500,000 coverage.

- Smoker and non-smoker rates are based on a Preferred or Preferred Tobacco health classification.

- Rates are a composite from major life insurance companies including Brighthouse Financial, Corebridge Financial, Legal & General America, Lincoln Financial, Mutual of Omaha, Pacific Life, Protective, Prudential, and Transamerica.

- This data is supplemented by the Policygenius Life Insurance Price Index, reflecting real-time pricing trends.

-

Important Notes:

- Rates may vary depending on the specific insurer, term length, coverage amount, health class, and state of residence.

- Not all policies are available in all states.

- This rate illustration is valid as of March 1, 2024.

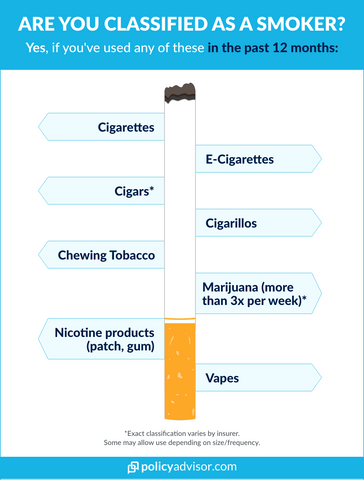

What Qualifies as a Smoker for Life Insurance?

Life insurance companies take a comprehensive approach to defining a smoker. They consider not just cigarettes but also e-cigarettes, vaping products, chewing tobacco, cigars, pipes, and even nicotine gum or patches. During the application process, you'll be asked about your tobacco use history, including the type of product used and frequency. A medical exam with nicotine testing might also be required. A positive nicotine test will likely classify you as a smoker for life insurance purposes.

How Does Tobacco Use Affect Life Insurance Options?

Smokers typically receive a lower health classification from insurance companies, which translates to higher premiums. The good news is that quitting smoking can improve your health classification and potentially lower your rates. Generally, one year of non-smoking is required to qualify for non-smoker rates. If you're initially denied coverage due to smoking, quitting and reapplying can make a difference.

What Life Insurance Companies Consider Smoking: A Wider Net Than You Think

For smokers looking for life insurance, understanding what constitutes "smoking" from a life insurance provider's perspective is crucial. It can affect your insurability and significantly impact your premium costs. Here's a breakdown of what typically counts as smoking for life insurance companies:

- Cigarettes: This is the most common and well-known tobacco product on the radar.

- E-cigarettes and Vaping: While some might perceive them as a healthier alternative, life insurance companies often group them with cigarettes due to the presence of nicotine and potential health risks.

- Smokeless Tobacco: Products like chewing tobacco, snuff, and dip all fall under the smoking umbrella for life insurance purposes.

- Cigars and Pipes: Although typically enjoyed less frequently than cigarettes, cigar and pipe smoking raise red flags for insurers due to tobacco use.

- Nicotine Replacement Therapy (NRT): This includes nicotine patches, gum, and lozenges. While designed to help quit smoking, they still contain nicotine and might affect your insurance classification.

The Key Ingredient: Nicotine

In essence, life insurance companies are concerned with nicotine use and its potential impact on your health. This explains why various tobacco products and even some NRT options are included in their definition of "smoking."

How Do They Find Out?

Life insurance companies have a multi-pronged approach to determine smoking history:

- Application Questions: You'll be asked detailed questions about your tobacco use, including the type of product, frequency, and quit date (if applicable).

- Medical Exam (if required): A medical exam might include blood or urine tests to detect cotinine, a byproduct of nicotine breakdown in the body. A positive test is a strong indicator of recent smoking.

The Bottom Line: Honesty is Key

Be truthful and transparent when answering questions about your tobacco use during the life insurance application process. Misrepresenting your smoking history could lead to a claim denial or a reduced payout if discovered during the contestability period (typically the first two years of the policy).

Best Life Insurance Companies for Smokers (2024)

Not all life insurance companies treat smokers equally. Some are more flexible regarding alternative tobacco use or the time elapsed since quitting. Here's a methodology for choosing the best companies for smokers:

- Affordability: Look for companies offering competitive rates for smokers.

- Underwriting Guidelines: Consider companies with lenient underwriting guidelines for tobacco use.

- Product Variety: Choose companies offering a variety of term and whole life insurance options.

- Financial Strength: Select companies with a strong financial rating to ensure they can pay out claims.

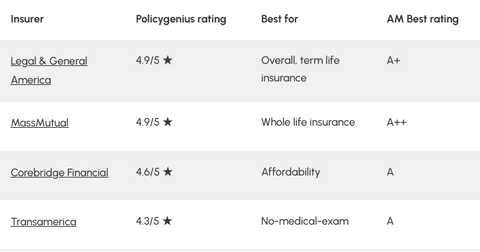

Top Picks for Smokers in 2024

Based on the criteria above, here are some of the best life insurance companies for smokers in 2024:

- Best Overall: Legal & General America - Offers affordable rates and flexible underwriting for smokers, with term lengths up to 40 years.

- Cheapest: Corebridge Financial - Known for offering competitive rates to smokers with common health conditions.

- Best No-Exam: Transamerica - Provides simplified-issue and guaranteed-issue life insurance options for smokers in good health, often without a medical exam.

- Best Whole Life: MassMutual - Offers whole life insurance with competitive rates for smokers and a strong history of paying high dividends (cash value payouts) on policies.

What Happens if You Start Smoking Again After Getting Life Insurance?

While your rates won't change if you start smoking again after getting life insurance, there could be consequences if you misrepresented yourself as a non-smoker during the contestability period (typically the first two years of the policy). In such cases, the insurance company might deny a claim or offer a reduced payout.

Other Health Concerns Affecting Life Insurance

Pre-existing health conditions and other health issues can also impact your life insurance options and costs. It's important to be honest about your health history during the application process.

Frequently Asked Questions (FAQ)

1. I quit smoking recently. How long do I need to wait for non-smoker rates?

Generally, you'll need to be smoke-free for at least one year to qualify for non-smoker rates. Some companies may require even longer depending on your previous smoking history.

2. Can I get life insurance if I use medical marijuana?

The legality of marijuana varies by state, and so do life insurance company policies. Some companies may offer coverage to medical marijuana users, while others might charge higher premiums or even deny coverage. It's important to be upfront about your marijuana use during the application process.

3. What if I only smoke occasionally?

Occasional smoking habits might be viewed differently by life insurance companies. Some may offer a lower smoking rate category for infrequent smokers compared to daily smokers. Be honest about your smoking habits when applying to get the most accurate rate quote.

4. I have a respiratory condition related to smoking. Will this affect my rates?

Yes, pre-existing health conditions, including those related to smoking, can significantly impact your life insurance rates or even make it difficult to qualify for coverage. However, it's still important to apply, as some companies may offer policies with exclusions or higher premiums depending on the severity of your condition.

5. Should I get a medical exam if I'm a smoker?

Whether you need a medical exam depends on the insurance company, the type of policy, and the amount of coverage you're seeking. Smokers are more likely to require a medical exam compared to non-smokers.

Conclusion: Breathe Easier with the Right Coverage and a Smoke-Free Future

While smoking can increase your life insurance premiums, it doesn't have to prevent you from securing the financial protection your loved ones deserve. By understanding your options and comparing rates, you can find an affordable plan that fits your budget.

More importantly, remember that quitting smoking is the single most important step you can take to improve your health and potentially lower your life insurance costs. VARON, a trusted supplier of oxygen concentrator therapy**, understands the importance of respiratory health. We encourage you to explore smoking cessation resources and prioritize your well-being.

Ready to take control of your health and secure your family's future? Contact a licensed insurance professional today to discuss your life insurance options.

Taking care of yourself is the greatest gift you can give to those who love you.

Additional Resources:

- https://www.policygenius.com/life-insurance/smokers/

- https://www.policyadvisor.com/life-insurance/life-insurance-for-smokers/

Dejar un comentario